In the world of trading, two markets have been making waves over the past few decades — Forex (foreign exchange) and cryptocurrency. Both offer the potential for profits, fast-paced action, and a steep learning curve. But they’re far from the same.

If you’re curious about getting into trading or just want to understand the key differences between these two markets, this article will break it down in a simple, human way — no heavy jargon, no confusing charts, just the basics you need to know.

What Is Forex Trading?

Forex trading is the act of buying and selling currencies. It’s the largest financial market in the world, with over $7 trillion traded daily. Yep, trillion with a “T”.

When you trade Forex, you’re essentially betting on the value of one currency against another. For example, you might trade the EUR/USD pair, meaning you’re speculating whether the Euro will go up or down against the US Dollar.

Forex is heavily influenced by global economic events, government policies, interest rates, and geopolitical news. It’s been around for decades and is backed by a well established financial system.

What Is Cryptocurrency Trading?

Cryptocurrency trading, on the other hand, is all about trading digital assets like Bitcoin, Ethereum, or Solana. These are decentralized currencies not controlled by any central authority (like a government or central bank). Instead, they run on blockchain technology.

Crypto markets are much newer Bitcoin, the first cryptocurrency, was launched in 2009. Since then, thousands of new coins have emerged, creating a diverse but highly volatile market.

Unlike Forex, crypto trading happens 24/7, and the market can swing wildly based on social media buzz, celebrity tweets, regulatory news, or even memes. It’s fast, unpredictable, and often driven more by speculation than fundamentals.

Key Differences Between Crypto and Forex Trading

Let’s compare the two in a few key areas:

1. Market Hours

- Forex: Open 24 hours a day, 5 days a week.

- Crypto: Open 24/7, including weekends and holidays.

If you’re someone who wants flexibility and the ability to trade anytime, crypto has the edge. But for those who like structured trading hours (and a little time off), Forex might be better.

2. Volatility

- Crypto: Extremely volatile. Price swings of 10–20% in a single day aren’t unusual.

- Forex: Generally less volatile. Major currency pairs usually move less dramatically.

Volatility means more opportunity for profit, but also more risk. Crypto is great for high-risk traders looking for quick gains (or losses), while Forex offers a more stable, predictable environment.

3. Liquidity

- Forex: Very high liquidity. It’s easy to enter and exit trades at almost any time.

- Crypto: Varies. Major coins like Bitcoin and Ethereum are very liquid, but smaller altcoins can be harder to trade.

In simpler terms, Forex is like a big highway with constant traffic, while crypto has both expressways (Bitcoin) and dirt roads (low-volume altcoins).

4. Leverage

- Forex: Offers regulated leverage — sometimes up to 50:1, depending on your region and broker.

- Crypto: Leverage is also available, often much higher (up to 100x), but comes with more risk and is less regulated.

High leverage can multiply your gains… or wipe out your account. Use with extreme caution, especially in crypto.

5. Regulation

- Forex: Heavily regulated in most countries. You’ll find plenty of reputable brokers with protections in place.

- Crypto: Lightly regulated in many areas. The landscape is evolving, but scams and unregulated exchanges are still a risk.

Forex offers more investor protection and stability. Crypto is still the Wild West in some respects.

Which One Should You Choose?

It really depends on your personality, goals, and risk tolerance. Here’s a quick breakdown:

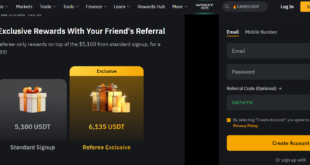

Crypto Trading Might Be Right for You If:

- You’re comfortable with high risk and volatility.

- You enjoy trading outside regular hours, including weekends.

- You’re interested in blockchain and the future of digital finance.

- You want access to a wider range of emerging assets.

Forex Trading Might Be Better If:

- You prefer a more structured, stable trading environment.

- You want to trade assets that are deeply rooted in economic fundamentals.

- You’re looking for tighter regulation and more security.

- You’re new to trading and want to start in a more established market.

Can You Trade Both?

Absolutely. Many traders dabble in both Forex and crypto to diversify their portfolios. The skills you build in one market — reading charts, managing risk, understanding macro trends — often carry over to the other.

However, jumping between the two too quickly can be overwhelming. It’s smart to master one before adding the other into your mix.

Crypto and Forex are both exciting, fast-moving markets with their own sets of pros and cons. Neither is inherently better — it all depends on how you like to trade and what kind of risk you’re willing to take.

- Forex is stable, regulated, and built on economic fundamentals.

- Crypto is innovative, volatile, and driven by tech and hype.

So whether you’re diving into digital assets or sticking with traditional currencies, do your homework, manage your risk, and trade smart.

Remember: the market doesn’t owe you anything — but with the right mindset and strategy, it can be a powerful place to grow your money.

Disclaimer: Trading involves significant risk and is not suitable for all investors. Always do your own research and consider consulting a financial advisor.

SpecDecoder

SpecDecoder