Cryptocurrency trading has exploded in popularity, and with it, dozens of trading platforms have popped up to meet demand. One platform that’s been gaining serious traction is Bybit known for its user friendly interface, fast execution, and strong focus on derivatives trading.

Whether you’re a total beginner or someone transitioning from another exchange, this guide will walk you through the essentials of trading crypto on Bybit, no fluff, no jargon overload, just straight-up guidance.

What is Bybit?

Bybit is a cryptocurrency exchange launched in 2018, and it quickly became a favorite among traders — especially those into derivatives (futures and perpetual contracts). It’s headquartered in Dubai and caters to both retail and professional traders.

What sets Bybit apart?

- Intuitive design

- Fast trading engine (100,000 TPS — yes, that’s fast)

- Strong security features

- Leverage up to 100x on select pairs

- 24/7 customer support

And yes, it also supports spot trading, staking, copy trading, and even an NFT marketplace.

Step-by-Step: Getting Started on Bybit

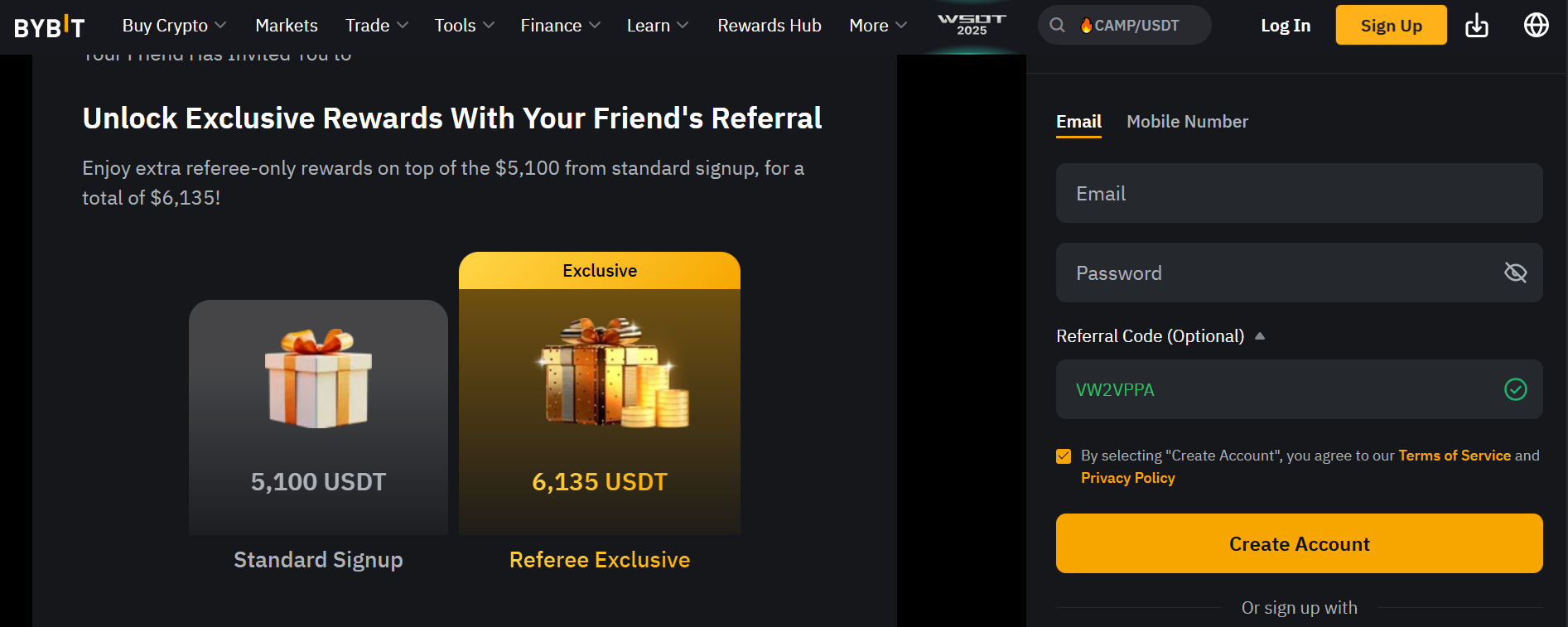

1. Sign Up for an Account

Go to bybit.com and click “Sign Up.” You can register using an email address or phone number. It’s quick, and you’ll be trading in minutes.

Tip: Enable 2-Factor Authentication (2FA) right after signing up for extra security.

2. Verify Your Identity (KYC)

While you can trade without KYC on a limited basis, verifying your identity unlocks higher withdrawal limits and full access to features.

Bybit’s KYC process is straightforward — upload a government-issued ID and a selfie. Approval typically takes less than an hour.

3. Deposit Funds

You can fund your account with:

- Crypto: BTC, ETH, USDT, and many other assets.

- Fiat: Bybit supports fiat deposits via bank transfer, credit card, or third-party providers (like Banxa or MoonPay).

Once funded, you’re ready to trade.

Bybit Trading Options Explained

Bybit offers multiple trading products. Here’s a quick breakdown of the most popular ones:

1. Spot Trading (Great for Beginners)

You buy and sell actual crypto assets (like BTC, ETH, SOL, etc.). Think of it like buying shares on a stock market.

- Pros: Simple, transparent, no liquidation risk.

- How to Start: Go to the “Trade > Spot” section, choose your trading pair (e.g., BTC/USDT), and place a Market or Limit order.

2. Derivatives Trading (For Advanced Users)

This includes USDT Perpetual, Inverse Perpetual, and Futures contracts. You’re not buying actual crypto — you’re trading contracts based on price movement.

- Leverage: Up to 100x on select pairs.

- Liquidation Risk: Yes, if your trade moves against you and you don’t manage your margin.

- Popular With: Short-term, high-risk traders.

You can go long (buy) if you think the price will go up or short (sell) if you believe it’ll go down.

3. Copy Trading (Passive Option)

Don’t feel confident enough to trade yourself? You can copy professional traders on Bybit. Just pick a trader based on their performance stats, allocate funds, and let them do the work.

- Risk Still Exists: Past performance ≠ future results.

- Good For: Beginners who want to learn while potentially earning.

Understanding the Interface (It’s Easier Than It Looks)

Bybit’s trading screen might look intimidating at first, but once you break it down, it’s quite friendly.

- Order Book: Shows real-time buy/sell orders.

- Price Chart: Powered by TradingView — customizable with indicators.

- Order Panel: Where you place your Market, Limit, or Conditional orders.

- Position Tab: Shows open trades, unrealized PnL, leverage used, etc.

Take your time to explore the interface with a small amount before going all in.

Managing Risk on Bybit

Crypto trading is exciting, but it’s also volatile especially with leverage involved. Here are a few tips to stay safe:

1. Start Small

Don’t throw your life savings in on day one. Start with a manageable amount, something you can afford to lose while learning.

2. Use Stop Losses

Always set a stop loss to limit your potential losses on a trade. It automatically closes your position if the market moves against you.

3. Mind the Leverage

Leverage can multiply gains — and losses. If you’re new, avoid high leverage (like 50x or 100x). Try 2x or 5x until you’re more confident.

4. Practice with a Testnet

Bybit offers a Testnet (demo environment) where you can practice trading with fake money. A perfect sandbox to build confidence without any risk.

Fees on Bybit

Bybit uses a maker-taker fee model:

- Spot Trading Fees:

- Maker: 0.1%

- Taker: 0.1%

- Derivatives Fees:

- Maker: 0.01%

- Taker: 0.06%

If you provide liquidity (maker), you pay slightly less than if you take liquidity (taker). Fees are competitive compared to other platforms.

Bonus Features Worth Exploring

Bybit isn’t just a place to trade. It has a few other cool features:

Bybit Earn

Earn passive income by staking or saving your crypto. Offers flexible and fixed terms with competitive APYs.

Launchpad

Participate in early-stage token launches. These can offer huge upside — but do your own research.

Grid Bots

Automated trading bots that use grid strategies to buy low/sell high within a price range — good for sideways markets.

Bybit is a solid platform for anyone looking to start or expand their crypto trading journey. It combines a clean user experience with powerful trading tools, making it suitable for both beginners and pros.

But remember: trading is not gambling, and it’s not a get-rich-quick scheme. It takes time, patience, and discipline to become consistently profitable. Use the tools Bybit offers, keep learning, and never risk more than you’re willing to lose.

Disclaimer: Cryptocurrency trading carries significant risk. This article is for educational purposes only and does not constitute financial advice.

SpecDecoder

SpecDecoder